Why Energy Infrastructure?

Home › Why Energy Infrastructure?

Power that Performs

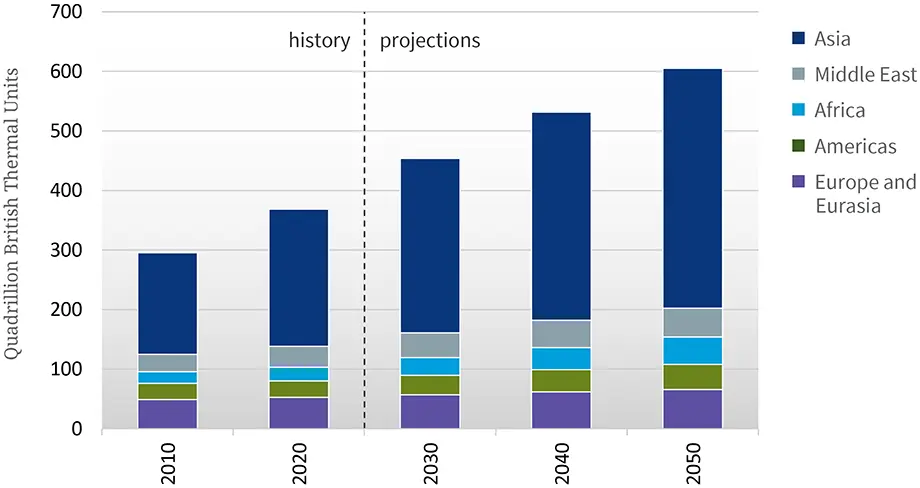

Despite its undeniable importance to the world, energy infrastructure can be an overlooked sector – though we believe this is poised to change soon … Global energy demand is forecast to see significant above-trend growth that will extend into the coming decades (view slide). We believe Midstream energy companies are well positioned to capitalize on that increased demand and support both traditional and transitional energy infrastructure.

Global Energy Demand

Source: IEO2021 Release, CSIS, October 6, 2021

Chickasaw Capital Management, LLC gives no guarantees with respect to the success of its investment management services and has not authorized any person to represent or guarantee any particular investment results. Any historical data provided herein are solely for the purpose of illustrating past performance and not as a representation or prediction that such performance could or will be achieved in the future.

No part of this material may be copied, photocopied or duplicated in any form, by any means, or redistributed without the prior written consent of Chickasaw Capital Management, LLC.

Certain information herein may be obtained from sources which we consider reliable, but we have not independently verified such information. We do not represent that such information is accurate or complete, and it should not be relied upon as such.

This material is provided for informational and educational purposes only and should not be construed as investment advice or an offer or solicitation to buy or sell any security, product or service.

PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS

Chickasaw’s renowned investment team is comprised of energy infrastructure specialists, providing capital and operational insight to select entities that are positioned to fuel the global economy. The entities and assets in which we invest provide enduring, essential services supplying the full range of end-users – consumers, industries, businesses, governments and society as a whole. Investing in energy infrastructure is investing in mission-critical real assets that can provide a compelling array of potential benefits.

Established Strategy

Chickasaw embraces an approach that recognizes both the prominence of traditional energy demand and the desire to transition toward other means of feeding our energy-hungry world. This disciplined, multi-pronged strategy allows us to seamlessly adapt to market dynamics, while striving for the most optimal investment outcomes.

Using a time-tested combination of proprietary operational models and qualitative analysis, our team evaluates each candidate in our investment universe in order to identify the most promising opportunities. Our 360° research view captures a clear and comprehensive view of supply and demand trends spanning the entire energy value chain. Reaching from research to the corporate world, we interface directly with the management teams of the companies in our portfolio, leveraging meaningful relationships we’ve cultivated across decades in the industry.

As asset managers and investors seek yield, liquidity and inflation adjusted cash flow growth, we believe investments in energy infrastructure will continue to deliver on those goals ... both now and well into the foreseeable future.

ENERGY INFRASTRUCTURE HIGHLIGHTS

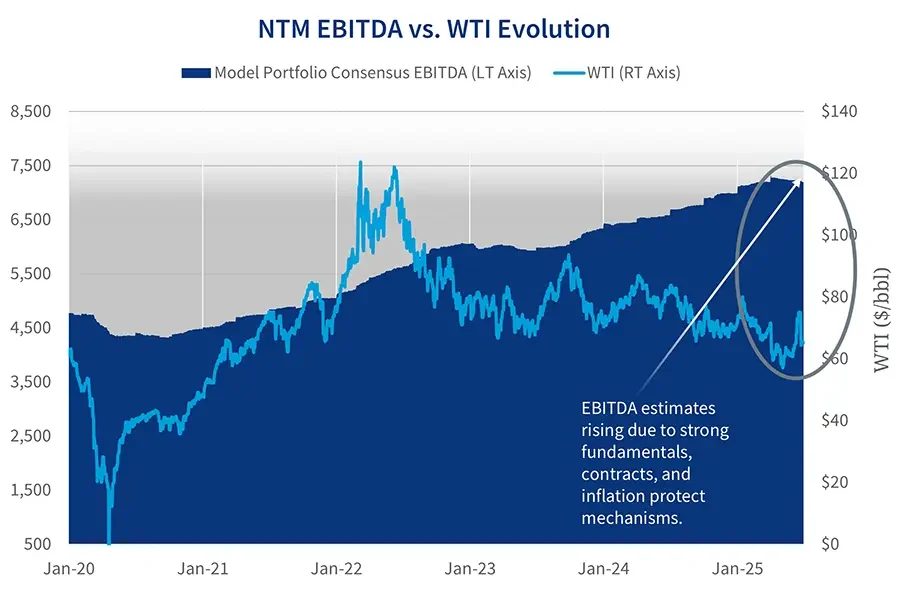

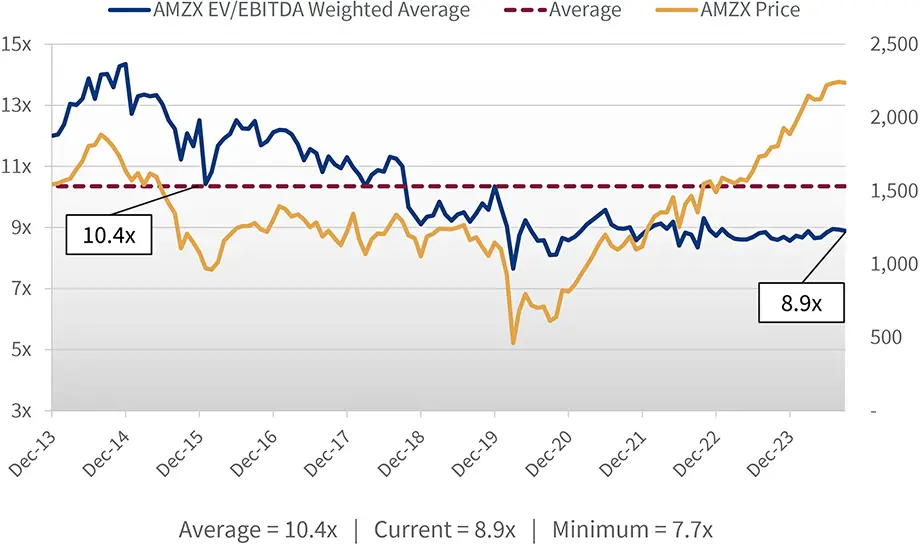

Valuation

Potential revaluation could be a source of return

Historical Cash Flow Stability

Attractive income supported by long-term contracts

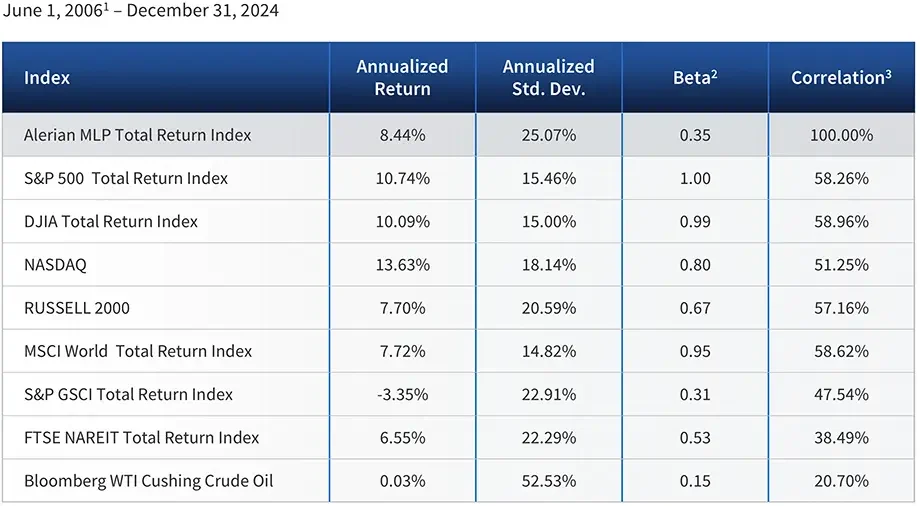

Comparison with

Other Asset Classes

Solid historical performance

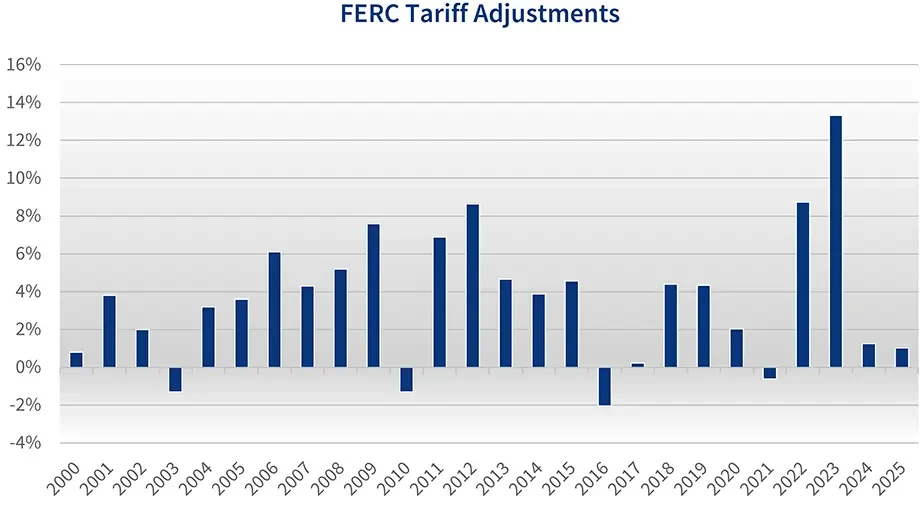

Inflation Hedge

History of outperforming other investments during high inflationary periods

Potential Tax Advantages

Distributions may be tax-deferred or subject to other preferential tax treatment

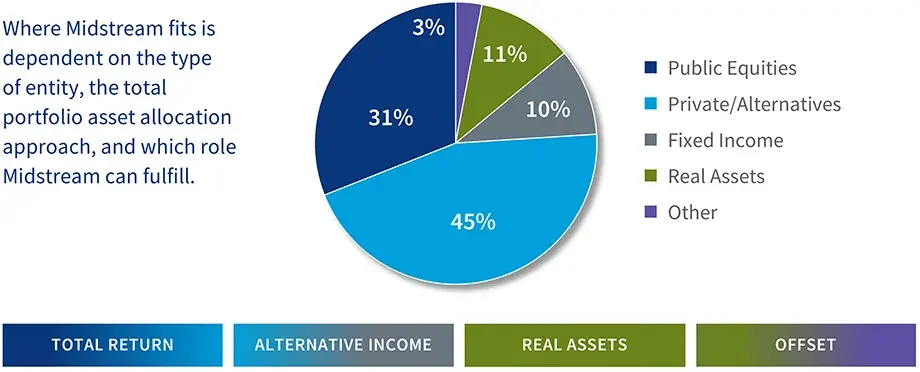

Allocation

Flexibility to play a role in several portfolio allocation categories

Video Presentations

State of U.S. Power Markets: Episode 2 – U.S. Power Generation: Demand at an Inflection Point

At a period of ever-increasing energy demand, we continue discussing various power sources and the role of natural gas and midstream

Midstream Update: Key Points, Second Quarter 2025

Video summary of our Midstream Update newsletter for the second quarter of 2025

State of U.S. Power Markets: Episode 1 – U.S. Power Generation

Discussion of various power sources and the role of natural gas and midstream in meeting increased electricity demand

Midstream Update: Key Points, Fourth Quarter 2024

Video summary of our Midstream Update newsletter for the fourth quarter of 2024

Midstream Update: Key Points, Third Quarter 2024

Video summary of our Midstream Update newsletter for the third quarter of 2024

The Evolution of Midstream Energy Infrastructure: Poised for the Transition, Episode 11 – Midstream Capital Structure

Investigation into the investment decision, funding decision and return of capital decision

Midstream Update: Key Points, First Quarter 2024

Video summary of our Midstream Update newsletter for the first quarter of 2024

The Evolution of Midstream Energy Infrastructure: Poised for the Transition, Episode 10 – Midstream Capital Allocation Overview, Part II

Deeper dive into key considerations of allocation decisions and focus on Chickasaw’s own allocation preferences

The Evolution of Midstream Energy Infrastructure: Poised for the Transition, Episode 9 – Midstream Capital Allocation Overview, Part I

Review of the historical shift to capital expenditures through to the current prioritization of higher returns and investor value

The Evolution of Midstream Energy Infrastructure: Poised for the Transition, Episode 8 – Liquefied Natural Gas (LNG) Market Overview

Coverage of the liquefied natural gas (LNG) lifecycle, from liquefaction to regasification, and its global market dynamics

The Evolution of Midstream Energy Infrastructure: Poised for the Transition, Episode 7 – Demand Forecast 101

Discussion of Midstream companies’ role in future energy demand in the context of the U.S. Energy Information Agency’s Annual Energy Outlook through 2050

The Evolution of Midstream Energy Infrastructure: Poised for the Transition, Episode 6 – Exports 101

Exploration of the mission-critical role that Midstream companies play in satisfying increasing international demand for U.S. raw and finished hydrocarbon products through exportation

The Evolution of Midstream Energy Infrastructure: Poised for the Transition, Episode 5 – Natural Gas Liquids (NGLs) Market Overview

The nature of NGLs along with their value chain, applications and supply/demand factors and status

The Evolution of Midstream Energy Infrastructure: Poised for the Transition, Episode 4 – U.S. Natural Gas Market Overview

A look at the dynamic evolution of the natural gas market in the U.S., spanning its array of applications and forecasted growth

The Evolution of Midstream Energy Infrastructure: Poised for the Transition, Episode 3 – Crude Market Overview

A look at global crude supply, demand and forecasts for the future – along with the factors that affect all three

The Evolution of Midstream Energy Infrastructure: Poised for the Transition, Episode 2 – Long-Term Drivers

Long-term drivers for Midstream equities through the lens of the EIA Annual Energy Outlook and the energy transition

The Evolution of Midstream Energy Infrastructure: Poised for the Transition, Episode 1 – Midstream 101

An overview of the history of Midstream and the current outlook for investment in the sector

Chickasaw Discussion Series: Episode 3

Discussion with Alan Armstrong, Chief Executive Officer, Williams Companies Inc. (NYSE: WMB)

Chickasaw Discussion Series: Episode 2

Discussion with Jennifer Kneale, Chief Financial Officer, Targa Resources Corp. (NYSE: TRGP)

Chickasaw Discussion Series: Episode 1

Discussion with Aaron Milford, Chief Operating Officer, Magellan Midstream Partners (NYSE: MMP)