Private Investment

Home › Private Investment

Private Funds

Chickasaw Capital Management sponsors and advises private investment funds, offering qualified investors the opportunity to invest in assets that may not be widely available to the public.

Private funds generally require significant minimum investment amounts and deploy capital over a defined period – ultimately divesting their assets through initial public offerings, mergers or private sales.

Private Equity

Our private equity strategy seeks to replicate the hallmarks and best practices of public energy infrastructure investing, including fee-based, long duration cash flows.

We identify attractive opportunities – through research practices our principals have developed across nearly three decades – and seek to help qualified investors achieve investment goals complementary to their current energy allocation.

Private Clients

As an independent wealth adviser, Chickasaw serves individuals, families, businesses and various institutions. Though many of our valued clients share the need for informed guidance and tailored strategies, we recognize that each relationship is unique. Our team is devoted to understanding and embracing the current circumstances, future goals and potential challenges involved in each situation. Consistent with our values, we aim to achieve the utmost level of service and performance for every client we serve.

One proven strategy, multiple ways to invest

Chickasaw’s signature approach to energy infrastructure asset management is available in a diverse range of solutions to meet different investor needs. From public to private and institutional to individual, all investors in the Chickasaw family benefit from our depth of experience and 360° research view – featuring our proprietary operational models and qualitative analysis tools – as well as our longstanding relationships with top management teams and unwavering commitment to our clients.

Research

In-depth company analyses + assessment of market supply & demand factors

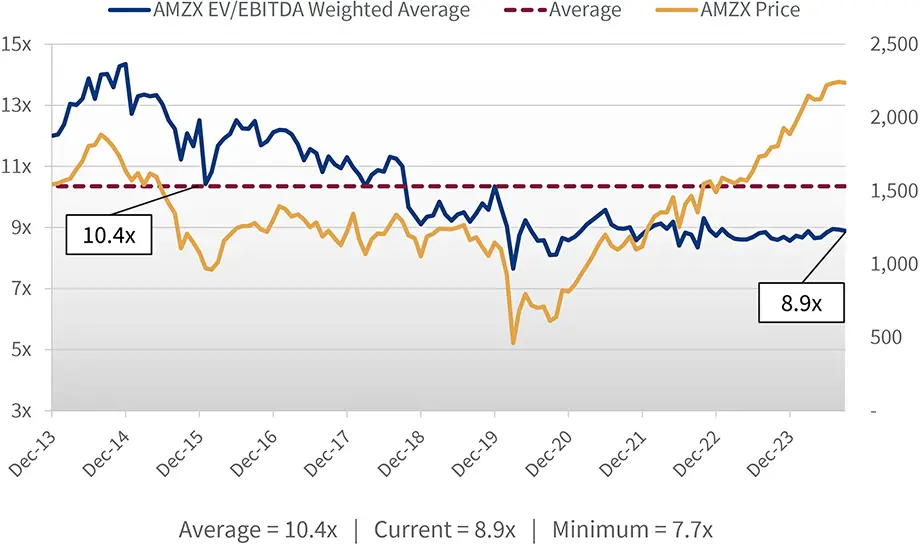

Appraise

Rigorous cash flow-based techniques to assess intrinsic value

Construct

Proven process to build a portfolio with lower risk + higher expected return

To learn more, contact us today.

The information is provided for informational purposes only, is not complete, and does not contain certain material information about Chickasaw Capital Management and any fund, including important disclosures and risk factors, and is subject to change without notice. This web site is not intended to be, nor should it be construed or used as an offer to sell, or a solicitation of any offer to buy an interest in any fund or any other entity, which offer may only be made at the time a qualified offeree receives a confidential private offering memorandum describing an offering and related subscription documents and other materials. Without limiting the generality of the foregoing, this web site does not constitute an invitation or inducement of any sort to any person in any jurisdiction in which such an invitation or inducement is not permitted or where Chickasaw Capital Management is not qualified to make such invitation or inducement.