Home › Contact Us

We appreciate your interest in Chickasaw Capital Management. If you’re ready for additional information or an informative conversation, please contact us today … We look forward to serving you.

Edward W. Kelly III

Managing Director

p 901.537.1866 or 800.743.5410

ed.kelly@chickasawcap.com

Steven M. Delarosa, CFA

Managing Director

p 901.537.1866 or 800.743.5410

steven.delarosa@chickasawcap.com

Source: Bloomberg LP, CCM, as of 12/31/24.

Chickasaw Capital Management, LLC gives no guarantees with respect to the success of its investment management services and has not authorized any person to represent or guarantee any particular investment results. Any historical data provided herein are solely for the purpose of illustrating past performance and not as a representation or prediction that such performance could or will be achieved in the future. Securities are subject to numerous risks, including market, currency, economic, political and business risks. Investments in securities will not always be profitable, and investors may lose money, including principal.

Chickasaw Capital Management, LLC does not provide legal, tax or accounting advice. Any statement contained in this communication concerning U.S. tax matters is not intended or written to be used, and cannot be used, for the purpose of avoiding penalties imposed on the relevant taxpayer. Clients of Chickasaw Capital Management, LLC should obtain their own independent tax advice based on their particular circumstances. Opinions expressed are current opinions as of the date appearing in this material only. No part of this material may be copied, photocopied or duplicated in any form, by any means, or redistributed without the prior written consent of Chickasaw Capital Management, LLC.

Certain information herein may be obtained from sources which we consider reliable, but we have not independently verified such information. We do not represent that such information is accurate or complete, and it should not be relied upon as such.

References to market or composite indices, benchmarks or other measures of relative market performance over a specified period of time (each, an “index”) are provided for your information only. Reference to this index does not imply that the portfolio will achieve returns, volatility or other results similar to the index. The composition of the index may not reflect the manner in which a portfolio is constructed in relation to expected or achieved returns, portfolio guidelines, restrictions, sectors, correlations, concentrations, volatility or tracking error targets, all of which are subject to change over time. Indices are unmanaged. The figures for the indices do not reflect the deduction of any fees or expenses which would reduce returns. Investors cannot invest directly in indices.

The Alerian MLP Index is a composite of the most prominent energy Master Limited Partnerships that provides investors with an unbiased, comprehensive benchmark for this emerging asset class. The index, which is calculated using a float-adjusted, capitalization-weighted methodology, is disseminated real-time on a price-return basis (NYSE: AMZ), and the corresponding total-return index is disseminated daily (NYSE: AMZX). Relevant data points such as dividend yield are also published daily. For index values, constituents, and announcements regarding constituent changes, please visit www.alerian.com.

“Alerian MLP Index”, “Alerian MLP Total Return Index”, “AMZ” and “AMZX” are servicemarks of GKD Index Partners, LLC d/b/a Alerian (“Alerian”) and their use is granted under a license from Alerian. Alerian does not guarantee the accuracy and/or completeness of the Alerian MLP Index or any data included therein and Alerian shall have no liability for any errors, omissions, interruptions or defects therein. Alerian makes no warranty, express or implied, representations or promises, as to results to be obtained by Licensee, or any other person or entity from the use of the Alerian MLP Index or any data included therein. Alerian makes no express or implied warranties, representations or promises, regarding the originality, merchantability, suitability, non-infringement, or fitness for a particular purpose or use with respect to the Alerian MLP Index or any data included therein. Without limiting any of the foregoing, in no event shall Alerian have any liability for any indirect, special, incidental, or consequential damages (including lost profits), arising out of the Alerian MLP Index or any data included therein, even if notified of the possibility of such damages.

The Energy MLP Classification Standard (“EMCS”) was developed by and is the exclusive property (and a service mark) of GKD Index Partners, LLC d/b/a Alerian (“Alerian”) and its use is granted under a license from Alerian. Alerian make no warranties, express or implied, or representations with respect to such standard or classification (or the results to be obtained by the use thereof), and hereby expressly disclaims all warranties of originality, accuracy, completeness, merchantability, suitability, non-infringement, or fitness for a particular purpose with respect to any such standard or classification. No warranty is given that the standard or classification will conform to any description thereof or be free of omissions, errors, interruptions, or defects. Without limiting any of the foregoing, in no event shall Alerian have any liability for any indirect, special, incidental, or consequential damages (including lost profits), arising out of any such standard or classification, even if notified of the possibility of such damages.

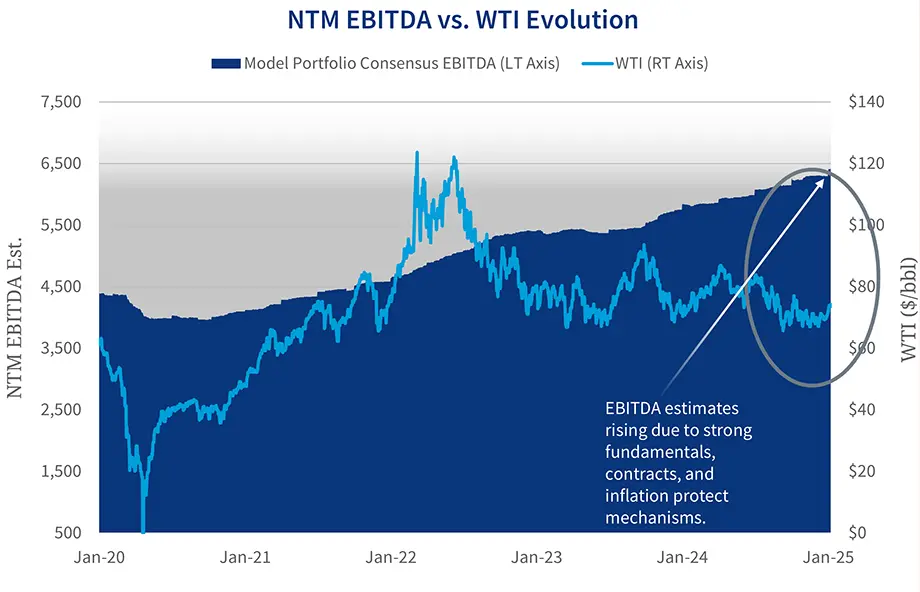

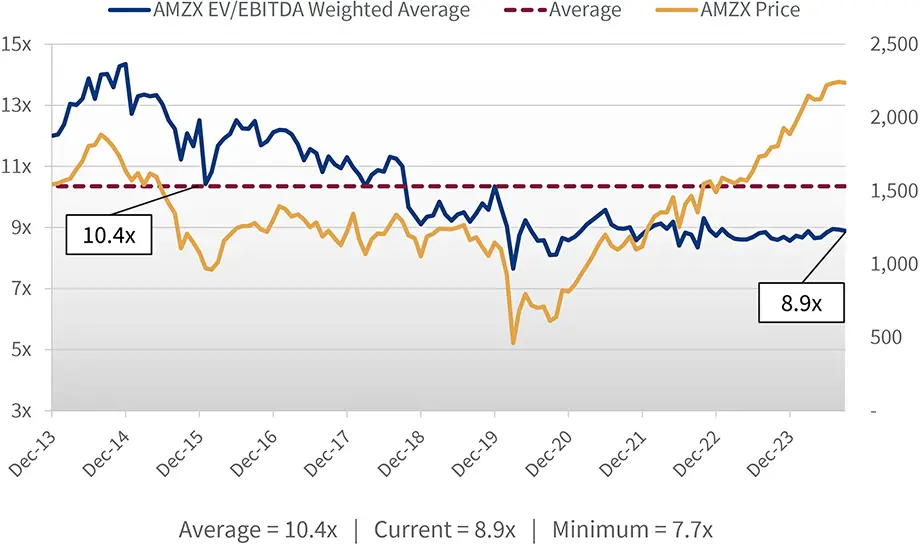

EBITDA is earnings before interest, taxes, depreciation and amortization.

EV/EBITDA is a ratio used to determine the value of a company. The enterprise multiple looks at a firm as a potential acquirer would, because it takes debt into account – an item which other multiples like the P/E ratio do not include. Enterprise multiple is calculated as: Enterprise multiple = EV/EBITDA.

This material is provided for informational and educational purposes only and should not be construed as investment advice or an offer or solicitation to buy or sell any security, product or service.

PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS

Source: Bloomberg, LP at 12/31/24.

All figures shown for current model portfolio weights and holdings. EBITDA is the consensus estimate at each point in time for the weighted sum of each portfolio holding for the next twelve months (NTM). This is not a forecast of the portfolio’s future performance. EBITDA growth does not guarantee a corresponding increase in the market value of the holding or the portfolio.

Chickasaw Capital Management, LLC gives no guarantees with respect to the success of its investment management services and has not authorized any person to represent or guarantee any particular investment results. Any historical data provided herein are solely for the purpose of illustrating past performance and not as a representation or prediction that such performance could or will be achieved in the future. Securities are subject to numerous risks, including market, currency, economic, political and business risks. Investments in securities will not always be profitable, and investors may lose money, including principal.

Chickasaw Capital Management, LLC does not provide legal, tax or accounting advice. Any statement contained in this communication concerning U.S. tax matters is not intended or written to be used, and cannot be used, for the purpose of avoiding penalties imposed on the relevant taxpayer. Clients of Chickasaw Capital Management, LLC should obtain their own independent tax advice based on their particular circumstances. Opinions expressed are current opinions as of the date appearing in this material only. No part of this material may be copied, photocopied or duplicated in any form, by any means, or redistributed without the prior written consent of Chickasaw Capital Management, LLC.

Certain information herein may be obtained from sources which we consider reliable, but we have not independently verified such information. We do not represent that such information is accurate or complete, and it should not be relied upon as such.

Cash Flow is a revenue or expense stream that changes a cash account over a given period. Cash inflows usually arise from one of three activities – financing, operations or investing – although this also occurs as a result of donations or gifts in the case of personal finance. Cash outflows result from expenses or investments. This holds true for both business and personal finance. Cash flow can be attributed to a specific project, or to a business as a whole. Cash flow can be used as an indication of a company’s financial strength.

EBITDA is earnings before interest, taxes, depreciation and amortization.

West Texas Intermediate (WTI), also known as Texas light sweet, is a grade of crude oil used as a benchmark in oil pricing. This grade is described as light because of its relatively low density, and sweet because of its low sulfur content. It is the underlying commodity of Chicago Mercantile Exchange’s oil futures contracts.

Information contains current holdings DTM, which IPO’d on 9/13/21 and KNTK which was reorganized in November 10, 2020. Information up through both dates, respectively, is adjusted to exclude the current weighting in DTM & KNTK. Impact to results is de minimis.

This material is provided for informational and educational purposes only and should not be construed as investment advice or an offer or solicitation to buy or sell any security, product or service.

PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS

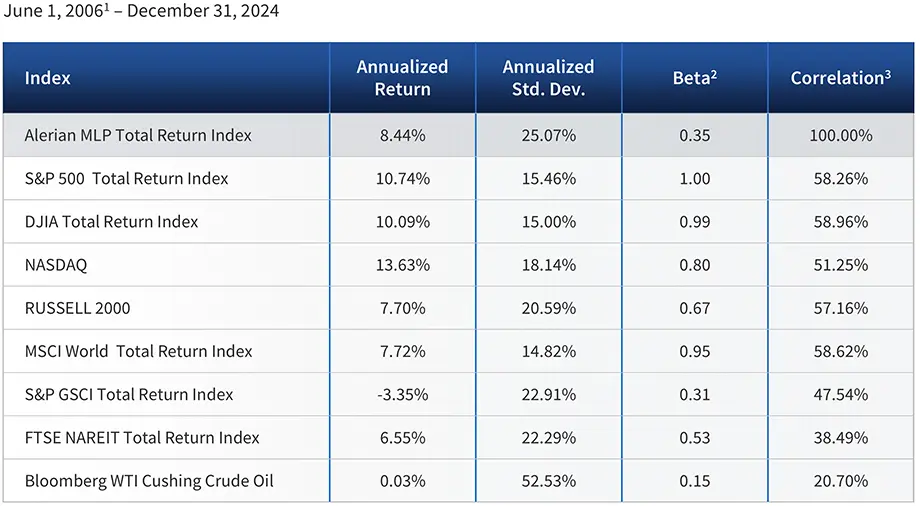

Solid historical performance

(1) Launch date of the Alerian MLP Total Return Index. (2) Relative to the S&P 500 Total Return Index calculated over the whole period (monthly data) based on excess return over 30 days T-Bills. (3) Relative to the Alerian MLP Total Return Index.

Chickasaw Capital Management, LLC gives no guarantees with respect to the success of its investment management services and has not authorized any person to represent or guarantee any particular investment results. Any historical data provided herein are solely for the purpose of illustrating past performance and not as a representation or prediction that such performance could or will be achieved in the future. Securities are subject to numerous risks, including market, currency, economic, political and business risks. Investments in securities will not always be profitable, and investors may lose money, including principal.

Chickasaw Capital Management, LLC does not provide legal, tax or accounting advice. Any statement contained in this communication concerning U.S. tax matters is not intended or written to be used, and cannot be used, for the purpose of avoiding penalties imposed on the relevant taxpayer. Clients of Chickasaw Capital Management, LLC should obtain their own independent tax advice based on their particular circumstances. Opinions expressed are current opinions as of the date appearing in this material only. No part of this material may be copied, photocopied or duplicated in any form, by any means, or redistributed without the prior written consent of Chickasaw Capital Management, LLC.

Certain information herein may be obtained from sources which we consider reliable, but we have not independently verified such information. We do not represent that such information is accurate or complete, and it should not be relied upon as such.

References to market or composite indices, benchmarks or other measures of relative market performance over a specified period of time (each, an “index”) are provided for your information only. Reference to this index does not imply that the portfolio will achieve returns, volatility or other results similar to the index. The composition of the index may not reflect the manner in which a portfolio is constructed in relation to expected or achieved returns, portfolio guidelines, restrictions, sectors, correlations, concentrations, volatility or tracking error targets, all of which are subject to change over time. Indices are unmanaged. The figures for the indices do not reflect the deduction of any fees or expenses which would reduce returns. Investors cannot invest directly in indices.

The Alerian MLP Index is a composite of the most prominent energy Master Limited Partnerships that provides investors with an unbiased, comprehensive benchmark for this emerging asset class. The index, which is calculated using a float-adjusted, capitalization-weighted methodology, is disseminated real-time on a price-return basis (NYSE: AMZ), and the corresponding total-return index is disseminated daily (NYSE: AMZX). Relevant data points such as dividend yield are also published daily. For index values, constituents, and announcements regarding constituent changes, please visit www.alerian.com.

“Alerian MLP Index”, “Alerian MLP Total Return Index”, “AMZ” and “AMZX” are servicemarks of GKD Index Partners, LLC d/b/a Alerian (“Alerian”) and their use is granted under a license from Alerian. Alerian does not guarantee the accuracy and/or completeness of the Alerian MLP Index or any data included therein and Alerian shall have no liability for any errors, omissions, interruptions or defects therein. Alerian makes no warranty, express or implied, representations or promises, as to results to be obtained by Licensee, or any other person or entity from the use of the Alerian MLP Index or any data included therein. Alerian makes no express or implied warranties, representations or promises, regarding the originality, merchantability, suitability, non-infringement, or fitness for a particular purpose or use with respect to the Alerian MLP Index or any data included therein. Without limiting any of the foregoing, in no event shall Alerian have any liability for any indirect, special, incidental, or consequential damages (including lost profits), arising out of the Alerian MLP Index or any data included therein, even if notified of the possibility of such damages.

The Energy MLP Classification Standard (“EMCS”) was developed by and is the exclusive property (and a service mark) of GKD Index Partners, LLC d/b/a Alerian (“Alerian”) and its use is granted under a license from Alerian. Alerian make no warranties, express or implied, or representations with respect to such standard or classification (or the results to be obtained by the use thereof), and hereby expressly disclaims all warranties of originality, accuracy, completeness, merchantability, suitability, non-infringement, or fitness for a particular purpose with respect to any such standard or classification. No warranty is given that the standard or classification will conform to any description thereof or be free of omissions, errors, interruptions, or defects. Without limiting any of the foregoing, in no event shall Alerian have any liability for any indirect, special, incidental, or consequential damages (including lost profits), arising out of any such standard or classification, even if notified of the possibility of such damages.

Bloomberg WTI Cushing Crude Oil: West Texas Intermediate (WTI), also known as Texas light sweet, is a grade of crude oil used as a benchmark in oil pricing. This grade is described as light because of its relatively low density, and sweet because of its low sulfur content. It is the underlying commodity of Chicago Mercantile Exchange’s oil futures contracts.

DJIA Total Return Index: Tracks the total return of The Dow Jones Industrial Average, a price-weighted average of 30 significant stocks traded on the New York Stock Exchange and the Nasdaq. Dividends are reinvested. The DJIA was invented by Charles Dow back in 1896.

FTSE NAREIT US Real Estate Total Return Index Series: Tracks the total return of the FTSE NAREIT US Real Estate Index Series which is designed to present investors with a comprehensive family of REIT performance indexes that spans the commercial real estate space across the US economy. Dividends are reinvested. The index series provides investors with exposure to all investment and property sectors. In addition, the more narrowly focused property sector and sub-sector indexes provide the facility to concentrate commercial real estate exposure in more selected markets.

MSCI World Total Return Index: Tracks the total return of the MSCI World Index, a market capitalization weighted index designed by Morgan Stanley Capital International to track the overall performance of commodity producers throughout the world. Dividends are reinvested. Stocks in the MSCI All Country World Commodity Producers Sector Capped Index are primarily focused on emerging market economies.

NASDAQ: A market-capitalization weighted index of the more than 3,000 common equities listed on the Nasdaq stock exchange. The types of securities in the index include American depositary receipts, common stocks, real estate investment trusts (REITs) and tracking stocks. The index includes all Nasdaq listed stocks that are not derivatives, preferred shares, funds, exchange-traded funds (ETFs) or debentures.

Russell 2000: An index measuring the performance approximately 2,000 small-cap companies in the Russell 3000 Index, which is made up of 3,000 of the biggest U.S. stocks. The Russell 2000 serves as a benchmark for small-cap stocks in the United States.

S&P 500 Total Return Index: Tracks the total return of the S&P 500 Index, an index of 500 stocks chosen for market size, liquidity and industry grouping, among other factors. Dividends are reinvested. The S&P 500 is designed to be a leading indicator of U.S. equities and is meant to reflect the risk/return characteristics of the large cap universe.

S&P GSCI Total Return Index: Tracks the total return of the S&P GSCI, a composite index of commodity sector returns representing an unleveraged, long-only investment in commodity futures that is broadly diversified across the spectrum of commodities. Dividends are reinvested. The returns are calculated on a fully collateralized basis with full reinvestment.

One cannot directly invest in an index.

Annualized Standard Deviation measures the dispersion or uncertainty in a random variable, such as an investment return. It measures the degree of variation of the random variable around the mean. The higher the volatility of the random variable, the higher the standard deviation will be. For this reason, standard deviation is often used as a measure of investment risk. Annualized Standard Deviation is equal to monthly standard deviation multiplied by the square root of 12.

Beta is the slope of the regression line. Beta measures the investment relative to the market. It describes the sensitivity of the investment to market movements. The market can be any index or investment specified.

Correlation measures the extent of linear association of two variables.

This material is provided for informational and educational purposes only and should not be construed as investment advice or an offer or solicitation to buy or sell any security, product or service.

PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS

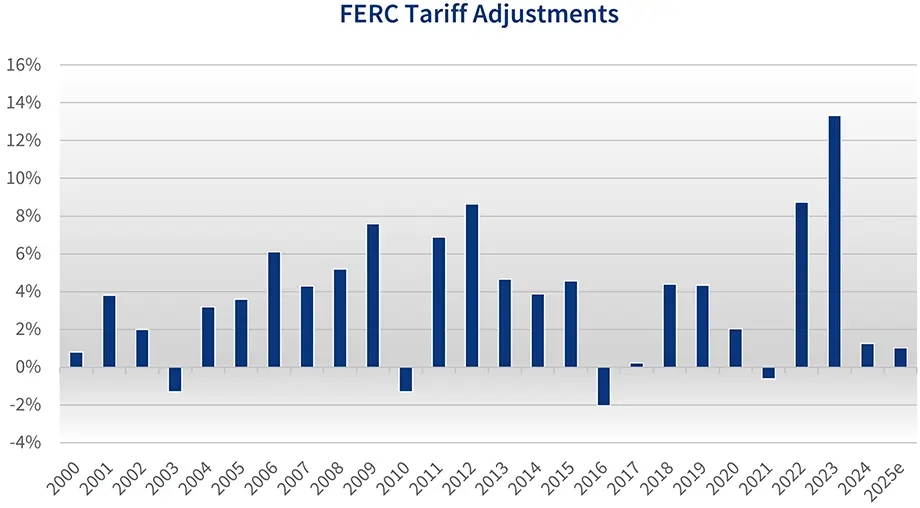

History of outperforming other investments during high inflationary periods

Chickasaw Capital Management, LLC gives no guarantees with respect to the success of its investment management services and has not authorized any person to represent or guarantee any particular investment results. Any historical data provided herein are solely for the purpose of illustrating past performance and not as a representation or prediction that such performance could or will be achieved in the future. Securities are subject to numerous risks, including market, currency, economic, political and business risks. Investments in securities will not always be profitable, and investors may lose money, including principal.

Chickasaw Capital Management, LLC does not provide legal, tax or accounting advice. Any statement contained in this communication concerning U.S. tax matters is not intended or written to be used, and cannot be used, for the purpose of avoiding penalties imposed on the relevant taxpayer. Clients of Chickasaw Capital Management, LLC should obtain their own independent tax advice based on their particular circumstances. Opinions expressed are current opinions as of the date appearing in this material only. No part of this material may be copied, photocopied or duplicated in any form, by any means, or redistributed without the prior written consent of Chickasaw Capital Management, LLC.

Certain information herein may be obtained from sources which we consider reliable, but we have not independently verified such information. We do not represent that such information is accurate or complete, and it should not be relied upon as such.

CPI (Consumer Price Index) is a measure of prices paid by consumers for a market basket of consumer goods and services. The yearly (or monthly) growth rates represent the inflation rate.

FERC is the U.S. Federal Energy Regulatory Commission.

PPI (Producer Price Index) is a measure of the change in the price of goods as they leave their place of production.

This material is provided for informational and educational purposes only and should not be construed as investment advice or an offer or solicitation to buy or sell any security, product or service.

PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS

Distributions may be tax-deferred or subject to other preferential tax treatment

Chickasaw Capital Management, LLC gives no guarantees with respect to the success of its investment management services and has not authorized any person to represent or guarantee any particular investment results. Any historical data provided herein are solely for the purpose of illustrating past performance and not as a representation or prediction that such performance could or will be achieved in the future. Securities are subject to numerous risks, including market, currency, economic, political and business risks. Investments in securities will not always be profitable, and investors may lose money, including principal.

Chickasaw Capital Management, LLC does not provide legal, tax or accounting advice. Any statement contained in this communication concerning U.S. tax matters is not intended or written to be used, and cannot be used, for the purpose of avoiding penalties imposed on the relevant taxpayer. Clients of Chickasaw Capital Management, LLC should obtain their own independent tax advice based on their particular circumstances. Opinions expressed are current opinions as of the date appearing in this material only. No part of this material may be copied, photocopied or duplicated in any form, by any means, or redistributed without the prior written consent of Chickasaw Capital Management, LLC.

Certain information herein may be obtained from sources which we consider reliable, but we have not independently verified such information. We do not represent that such information is accurate or complete, and it should not be relied upon as such.

This material is provided for informational and educational purposes only and should not be construed as investment advice or an offer or solicitation to buy or sell any security, product or service.

PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS

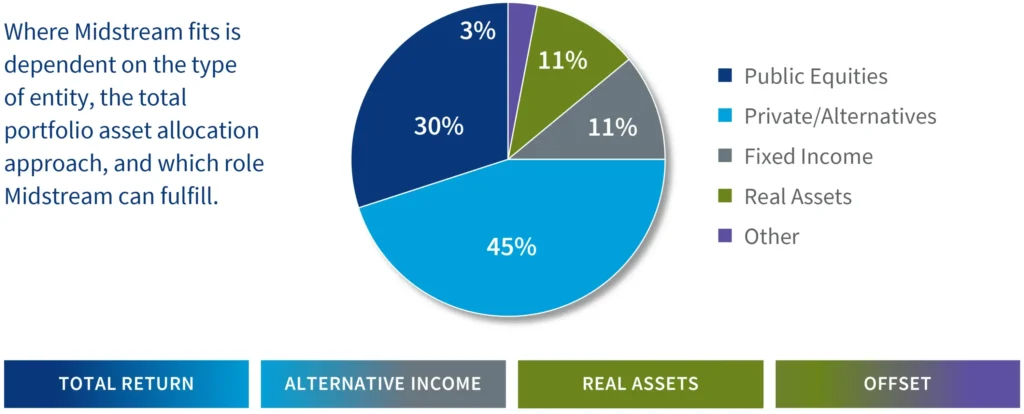

Flexibility to play a role in several portfolio allocation categories

Note: Figures may not equal 100% due to rounding.

Source: NACUBO, “2023 NACUBO-Commonfund Study of Endowments”, 2/15/24.

Chickasaw Capital Management, LLC gives no guarantees with respect to the success of its investment management services and has not authorized any person to represent or guarantee any particular investment results. Any historical data provided herein are solely for the purpose of illustrating past performance and not as a representation or prediction that such performance could or will be achieved in the future. Securities are subject to numerous risks, including market, currency, economic, political and business risks. Investments in securities will not always be profitable, and investors may lose money, including principal.

Chickasaw Capital Management, LLC does not provide legal, tax or accounting advice. Any statement contained in this communication concerning U.S. tax matters is not intended or written to be used, and cannot be used, for the purpose of avoiding penalties imposed on the relevant taxpayer. Clients of Chickasaw Capital Management, LLC should obtain their own independent tax advice based on their particular circumstances. Opinions expressed are current opinions as of the date appearing in this material only. No part of this material may be copied, photocopied or duplicated in any form, by any means, or redistributed without the prior written consent of Chickasaw Capital Management, LLC.

Certain information herein may be obtained from sources which we consider reliable, but we have not independently verified such information. We do not represent that such information is accurate or complete, and it should not be relied upon as such.

Cash Flow is a revenue or expense stream that changes a cash account over a given period. Cash inflows usually arise from one of three activities – financing, operations or investing – although this also occurs as a result of donations or gifts in the case of personal finance. Cash outflows result from expenses or investments. This holds true for both business and personal finance. Cash flow can be attributed to a specific project, or to a business as a whole. Cash flow can be used as an indication of a company’s financial strength.

Distributions are quarterly dividend payments made to Limited Partner (LP) and General Partner (GP) investors. These amounts are set by the GP and are supported by an MLP’s operating cash flows.

Distribution Coverage Ratio is calculated as cash available to limited partners divided by cash distributed to limited partners. It gives an indication of an MLP’s ability to make dividend payments to limited partner investors from operating cash flows. MLPs with a coverage ratio of in excess of 1.0 times are able to meet their dividend payments without external financing.

Yield refers to the cash dividend or distribution divided by the share or unit price at a particular point in time.

This material is provided for informational and educational purposes only and should not be construed as investment advice or an offer or solicitation to buy or sell any security, product or service.

PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS

Source: Bloomberg LP, CCM, as of 9/30/24.

Chickasaw Capital Management, LLC gives no guarantees with respect to the success of its investment management services and has not authorized any person to represent or guarantee any particular investment results. Any historical data provided herein are solely for the purpose of illustrating past performance and not as a representation or prediction that such performance could or will be achieved in the future. Securities are subject to numerous risks, including market, currency, economic, political and business risks. Investments in securities will not always be profitable, and investors may lose money, including principal.

Chickasaw Capital Management, LLC does not provide legal, tax or accounting advice. Any statement contained in this communication concerning U.S. tax matters is not intended or written to be used, and cannot be used, for the purpose of avoiding penalties imposed on the relevant taxpayer. Clients of Chickasaw Capital Management, LLC should obtain their own independent tax advice based on their particular circumstances. Opinions expressed are current opinions as of the date appearing in this material only. No part of this material may be copied, photocopied or duplicated in any form, by any means, or redistributed without the prior written consent of Chickasaw Capital Management, LLC.

Certain information herein may be obtained from sources which we consider reliable, but we have not independently verified such information. We do not represent that such information is accurate or complete, and it should not be relied upon as such.

References to market or composite indices, benchmarks or other measures of relative market performance over a specified period of time (each, an “index”) are provided for your information only. Reference to this index does not imply that the portfolio will achieve returns, volatility or other results similar to the index. The composition of the index may not reflect the manner in which a portfolio is constructed in relation to expected or achieved returns, portfolio guidelines, restrictions, sectors, correlations, concentrations, volatility or tracking error targets, all of which are subject to change over time. Indices are unmanaged. The figures for the indices do not reflect the deduction of any fees or expenses which would reduce returns. Investors cannot invest directly in indices.

The Alerian MLP Index is a composite of the most prominent energy Master Limited Partnerships that provides investors with an unbiased, comprehensive benchmark for this emerging asset class. The index, which is calculated using a float-adjusted, capitalization-weighted methodology, is disseminated real-time on a price-return basis (NYSE: AMZ), and the corresponding total-return index is disseminated daily (NYSE: AMZX). Relevant data points such as dividend yield are also published daily. For index values, constituents, and announcements regarding constituent changes, please visit www.alerian.com.

“Alerian MLP Index”, “Alerian MLP Total Return Index”, “AMZ” and “AMZX” are servicemarks of GKD Index Partners, LLC d/b/a Alerian (“Alerian”) and their use is granted under a license from Alerian. Alerian does not guarantee the accuracy and/or completeness of the Alerian MLP Index or any data included therein and Alerian shall have no liability for any errors, omissions, interruptions or defects therein. Alerian makes no warranty, express or implied, representations or promises, as to results to be obtained by Licensee, or any other person or entity from the use of the Alerian MLP Index or any data included therein. Alerian makes no express or implied warranties, representations or promises, regarding the originality, merchantability, suitability, non-infringement, or fitness for a particular purpose or use with respect to the Alerian MLP Index or any data included therein. Without limiting any of the foregoing, in no event shall Alerian have any liability for any indirect, special, incidental, or consequential damages (including lost profits), arising out of the Alerian MLP Index or any data included therein, even if notified of the possibility of such damages.

The Energy MLP Classification Standard (“EMCS”) was developed by and is the exclusive property (and a service mark) of GKD Index Partners, LLC d/b/a Alerian (“Alerian”) and its use is granted under a license from Alerian. Alerian make no warranties, express or implied, or representations with respect to such standard or classification (or the results to be obtained by the use thereof), and hereby expressly disclaims all warranties of originality, accuracy, completeness, merchantability, suitability, non-infringement, or fitness for a particular purpose with respect to any such standard or classification. No warranty is given that the standard or classification will conform to any description thereof or be free of omissions, errors, interruptions, or defects. Without limiting any of the foregoing, in no event shall Alerian have any liability for any indirect, special, incidental, or consequential damages (including lost profits), arising out of any such standard or classification, even if notified of the possibility of such damages.

EBITDA is earnings before interest, taxes, depreciation and amortization.

EV/EBITDA is a ratio used to determine the value of a company. The enterprise multiple looks at a firm as a potential acquirer would, because it takes debt into account – an item which other multiples like the P/E ratio do not include. Enterprise multiple is calculated as: Enterprise multiple = EV/EBITDA.

This material is provided for informational and educational purposes only and should not be construed as investment advice or an offer or solicitation to buy or sell any security, product or service.

PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS

This link leads to the machine-readable files that are made available in response to the federal Transparency in Coverage Rule and includes negotiated service rates and out-of-network allowed amounts between health plans and healthcare providers. The machine-readable files are formatted to allow researchers, regulators, and application developers to more easily access and analyze data.

We have developed a Business Continuity Plan on how we will respond to events that significantly disrupt our business. Since the timing and impact of disasters and disruptions are unpredictable, we will have to be flexible in responding to actual events as they occur. With that in mind, we are providing you with this information on our business continuity plan.

Contacting Us – If after a significant business disruption you cannot contact us as you usually do at 901-537-1866 or 800-743- 5410, you should go to our web site at www.chickasawcap.com for further direction.

Our Business Continuity Plan – We plan to quickly recover and resume business operations after a significant business disruption and respond by safeguarding our employees and property, making a financial and operational assessment, protecting the firm’s books and records, and allowing our customers to transact business. In short, our business continuity plan is designed to permit our firm to resume operations as quickly as possible, given the scope and severity of the significant business disruption.

Our business continuity plan addresses: data backup and recovery; all mission critical systems; financial and operational assessments; alternative communications with customers, employees, and regulators; alternate physical location of employees; critical supplier, contractor, bank and counter-party impact; regulatory reporting; and assuring our customers prompt access to their funds and securities if we are unable to continue our business.

We back up important records in a geographically separate area. While every emergency situation poses unique problems based on external factors, such as time of day and the severity of the disruption, our objective is to restore operations and be able to complete existing transactions and accept new transactions and payments within 24 hours. Your orders and requests for funds and securities could be delayed during this period.

Varying Disruptions – Significant business disruptions can vary in their scope, such as only our firm, a single building housing our firm, the business district where our firm is located, the city where we are located, or the whole region. Within each of these areas, the severity of the disruption can also vary from minimal to severe. In a disruption to only our firm or a building housing our firm, we will transfer our operations to a local site when needed and expect to recover and resume business within 2 hours. In a disruption affecting our business district, city, or region, we will transfer our operations to a site outside of the affected area, and recover and resume business within 24 hours. In either situation, we plan to continue in business and notify you how to contact us through our web site www.chickasawcap.com. If the significant business disruption is so severe that it prevents us from remaining in business, we will assure our customers prompt access to their funds and securities.

For more information – If you have questions about our business continuity planning, you can contact us at 901-537-1866 or 800-743-5410.

Chickasaw Capital Management, LLC (“Chickasaw”) is not affiliated with any social media site and does not expressly or implicitly adopt or endorse any products, sponsored or promoted content, services, advertisements, recommendations, opinions, statements, comments, or responses that may appear on any social media site, including social media sites that it actively participates in. Use at your own risk. Opinions or comments expressed by third-party users of each social media site are those of the persons submitting them and do not represent the view of Chickasaw. Read the terms of service and privacy policy on each social media site.

Chickasaw social media accounts are open to the public. Anything posted to our social media networks may be seen and read by everyone. Chickasaw does not endorse any comments made by third parties, including, but not limited to vendors, consultants, and unauthorized employees. Chickasaw reserves the right to remove any comments or content depending on the comment or response structure of a particular social media site and the editorial policies and content guidelines of the particular social media site. For example, comments or responses may be removed if they constitute defamatory statements; threatening language; materials that infringe on intellectual property rights; materials that contain viruses, spam or other harmful components; racially offensive statements; or profanity.

The views and opinions expressed on Chickasaw spokesperson accounts are those of each individual and do not necessarily represent those of Chickasaw. The comments are provided for informational purposes only and should not be construed as investment advice or an offer or solicitation to buy or sell any security, product or service of Chickasaw or any third party.

Social media sites on which Chickasaw participates may be moderated. Chickasaw may manage a variety of social media channels, and to the extent permitted by the comment or response structure of a particular social media site and the editorial policies and content guidelines of the particular social media site, Chickasaw strives to create an informative and engaging community. To this end, Chickasaw asks that you keep any dialog respectful of others, and refrain from any discussion about investment advice, specific securities, or investment strategies. Chickasaw expects that social media communications between Chickasaw and its intended audience will be lawful, productive, informative, and respectful of diverse viewpoints. Chickasaw’s social media activities are intended for U.S. persons only.

Chickasaw’s social media sites are not intended to provide advice on legal, tax or accounting matters and any information on Chickasaw’s social media sites is not intended or written to be used, and cannot be used, for the purpose of avoiding penalties that may be imposed on any taxpayer under U.S. federal income tax laws. Investors should consult their own legal, tax, accounting, investment or other advisors and obtain their own independent tax advice at both the onset of any transaction and on an ongoing basis to determine the laws and analyses applicable to their specific circumstances.

Chickasaw gives no guarantees with respect to the success of its investment management services and has not authorized any person to represent or guarantee any particular investment results. Any historical data provided on Chickasaw’s social media sites are solely for the purpose of illustrating past performance and not as a representation or prediction that such performance could or will be achieved in the future. Securities are subject to numerous risks, including market, currency, economic, political and business risks. Investments in securities will not always be profitable, and investors may lose money, including principal. Past performance is no guarantee of future results.

Transaction requests, account inquiries or complaints of any sort related to the activities or business dealings of Chickasaw or its employees should not be made through any social media site. If you believe, in good faith, that material available on a Chickasaw social media site is infringing on your intellectual property rights, please contact us at ChickasawCompliance@chickasawcap.com.

Please visit our web site at www.chickasawcap.com for more information.

Last Revised: 3/31/2021

Last updated January 13, 2016

The www.chickasawcap.com website (the “Website”) is a service of Chickasaw Capital Management, LLC (“CCM,” “us” or “we”). These www.chickasawcap.com Terms & Conditions and any additional terms or conditions that we post on the Website from time-to-time (“Terms”) set forth the terms and conditions under which you may enter and use the Website. As used herein CCM means CCM and its affiliates.

Please read the Terms carefully. By entering or using the Website, you agree to the Terms. If you do not agree to the Terms (without modification), you are not authorized to view or use the Website.

CCM reserves the right to modify or change the Terms at any time without prior notice to you. Such modification or change shall be effective upon posting on the Website. If CCM revises the Terms, it will also revise the “Last Updated” date at the top of this page. The most current version of the Terms can be reviewed by clicking on the “Terms & Conditions” hypertext link located at the bottom of CCM’s web pages. Your continued entry to and/or use of the Website after CCM posts any revised Terms constitutes your agreement to any such revised Terms.

Disclaimer: This material should not be construed as an offer to sell or the solicitation of an offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal. We are not soliciting any action based on this material, nor are we making any recommendation. This material is general information. It does not take into account the particular investment objectives, financial situations, or needs of individual clients. Before acting on any advice or recommendation in this material, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Securities or financial instruments mentioned in the Website may not be suitable or appropriate for all investors or in all geographical areas.

Nothing contained on this Website constitutes tax, legal, insurance or investment advice. In exchange for using this Website, the visitor agrees to indemnify and hold CCM, its officers, directors, employees, affiliates, agents, licensors and suppliers harmless against any and all claims, losses, liability, costs and expenses (including but not limited to attorneys’ fees) arising from your violation of these Terms.

THE INFORMATION AND SERVICES PROVIDED ON THIS WEBSITE ARE PROVIDED “AS IS” AND WITHOUT WARRANTIES OF ANY KIND, EITHER EXPRESSED OR IMPLIED. TO THE FULLEST EXTENT PERMISSIBLE PURSUANT TO APPLICABLE LAW, CCM DISCLAIMS ALL WARRANTIES, INCLUDING, BUT NOT LIMITED TO, ANY WARRANTY OF NON-INFRINGEMENT OF THIRD-PARTY RIGHTS AND ANY IMPLIED WARRANTIES OF MERCHANTABILITY AND FITNESS FOR A PARTICULAR PURPOSE. CCM DOES NOT WARRANT, EITHER EXPRESSLY OR IMPLIEDLY, THE ACCURACY OR COMPLETENESS OF THE INFORMATION, TEXT, GRAPHICS, LINKS OR OTHER ITEMS CONTAINED ON THIS WEBSITE AND DOES NOT WARRANT THAT THE FUNCTIONS CONTAINED IN THIS WEBSITE WILL BE UNINTERRUPTED OR ERROR-FREE, THAT DEFECTS WILL BE CORRECTED, OR THAT THE WEBSITE WILL BE FREE OF VIRUSES OR OTHER HARMFUL COMPONENTS.

Use of Website. Conditioned upon, and subject to, your strict compliance with the Terms, CCM grants you a personal, non-exclusive, non-transferable, limited license to enter and use the Website to view information. You agree not to enter or use the Website for any purpose that is prohibited by these Terms or is otherwise unlawful. You further agree to comply with all applicable U.S. and international laws, statutes, ordinances, regulations, contracts and applicable licenses regarding your use of the Website.

Information Provided. If you provide any information to us, you agree to provide only true, accurate, current and complete information.

Use of Content. You may print or copy any information displayed or transmitted on the Website (collectively, “Content”) that you are authorized to access, solely for informational and non-commercial, personal use; provided that you (a) do not remove any title, trademark, copyright and/or restricted rights notices contained on such Content, and (b) strictly comply with the provisions of the Terms.

Restrictions. Except as provided in above, you may not (and you agree that you will not) reproduce, alter, modify, create derivative works, or publicly display any Content without first receiving CCM’s express written permission.

Except for Content that is in the public domain, the Website and all original Content, as well as the selection and arrangement of the Content, is owned by (or licensed to) CCM or its suppliers and is protected by copyright, trade dress, trademark, unfair competition, and/or other laws and may not be used, copied or imitated in whole or in part except as expressly provided herein.

Links to Other Websites: CCM may provide hyperlinks to other web sites and Internet resources operated by parties other than CCM. CCM has no control over such sites and resources or their privacy policies.

Links to CCM From Other Websites: Subject to the further provisions of this Section, CCM must pre-approve links to the Website from other web sites.

Transmissions to and From This Website: Electronic communications can be intercepted by third parties and, accordingly, transmissions to and from this Website may not be secure. Communications to CCM, particularly those containing confidential information, may be sent by mail to: Chickasaw Capital Management, 6075 Poplar Avenue, Suite 720, Memphis, TN 38119.

Jurisdiction: The information provided on this Website is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject CCM or its affiliates to any registration requirement within such jurisdiction or country.

Integration, Severability and Governing Law: These Terms shall be subject to any other agreements you have entered into with CCM. Your access to and use of the Website, and the terms of this disclaimer are governed by Tennessee law. Any action against CCM arising from or relating to your access to and/or use of the Website and the provisions of these Terms must be brought by you in state or federal court located in the State of Tennessee, County of Shelby.

Effective as of March 13, 2020

We are committed to keeping the personal information collected from our potential, current and former customers confidential and secure. The proper handling of personal information is one of our highest priorities. We want to be sure that you know why we need to collect personal information from you. We also want to explain to you our commitment to protect the information you provide to us. We never sell your information to any outside parties.

We collect and keep only information that is necessary for us to provide services requested by you and to administer your business with us. We may collect nonpublic personal information:

Financial companies choose how they share your personal information. Federal law gives the consumer the right to limit some but not all sharing. All financial companies need to share their customers’ personal information to run their everyday business. We only share your nonpublic personal information with non‐affiliated companies, affiliates or individuals as permitted or required by law.

When we provide personal information to a service provider, we require these providers to agree to safeguard your information, to use the information only for the intended purpose, to perform the specific service we have requested, and to abide by applicable law.

We provide a website on the Internet for our company which is informational only. You should check the privacy policy for any links provided upon leaving our web site. We provide access to your securities accounts via the Internet. Your password is your private entry key into your account. You should never share it with anyone, and you should change it periodically.

Only persons with a valid business reason have access to your personal information. These persons are educated on the importance of maintaining the confidentiality and security of this information. They are required to abide by our information handling practices.

We maintain security standards to protect your information, whether written, spoken, or electronic. We update and test our systems to ensure the protection and integrity of information.

As a member of the financial services industry, we are sending you this Notice of Privacy Policy for informational purposes and will update and distribute it as required by law. It is also available upon request.

If you prefer that we not disclose nonpublic personal information about you to nonaffiliated third parties, you may opt out of those disclosures, that is, you may direct us not to make those disclosures (other than disclosures permitted or required by law). If you wish to opt out of disclosures to nonaffiliated third parties, you may call the following toll‐free number: 1‐800‐743‐5410.

If your customer relationship with us ends, we will not destroy your personal information unless required or permitted by law. We will continue to treat your personal information in accordance with this Privacy Policy and applicable laws.

We do not have the protocol that offers you the choice to opt‐out of internet tracking. You may reset your web browser to enable do not track functionality if your browser supports it.

When you visit our site, we may collect information about your use of our site through “cookies”. Cookies are small bits of information transferred to your computer’s hard drive that allow us to know how often a user visits our site and the activities they are most interested in performing. We require the acceptance of cookies to enable users to take full advantage of specific services offered.

We may collect, process or disclose certain personal information of California residents that is subject to certain provisions of the California Consumer Privacy Act of 2018, as amended (the “CCPA”). California residents have the following rights with respect to such personal information to the extent such information is subject to the provisions of the CCPA.

Category of Personal Information | Examples | Whether Collected | Whether Disclosed for a Business Purpose |

|---|---|---|---|

(A) Identifiers | Real name, alias, postal address, unique personal identifier, online identifier, Internet Protocol address, email address, account name, social security number, driver’s license number, passport number, or other similar identifiers | YES | YES |

(B) Personal information categories listed in the California Customer Records statute | Name, signature, social security number, physical characteristics or description, address, telephone number, passport number, driver’s license or state identification card number, insurance policy number, education, employment, employment history, bank account number, credit card number, debit card number, or any other financial information | YES | YES |

(C) Protected classifications | Age, race, color, ancestry, national origin, citizenship, religion or creed, marital status, medical condition, physical or mental disability, sex/gender, sexual orientation, veteran status, genetic information | YES | YES |

(D) Commercial information | Records of personal property, products or services purchased, obtained, or considered, or other purchasing or consuming histories or tendencies | YES | YES |

We obtain the categories of personal information listed above from the following categories of sources:

For questions or concerns about our privacy practices, please contact us at:

Phone: 901‐537‐1866 or 800‐743‐5410

Website: www.chickasawcap.com

You will now be leaving the Chickasaw Capital Management website and entering the MainGate MLP Fund website.